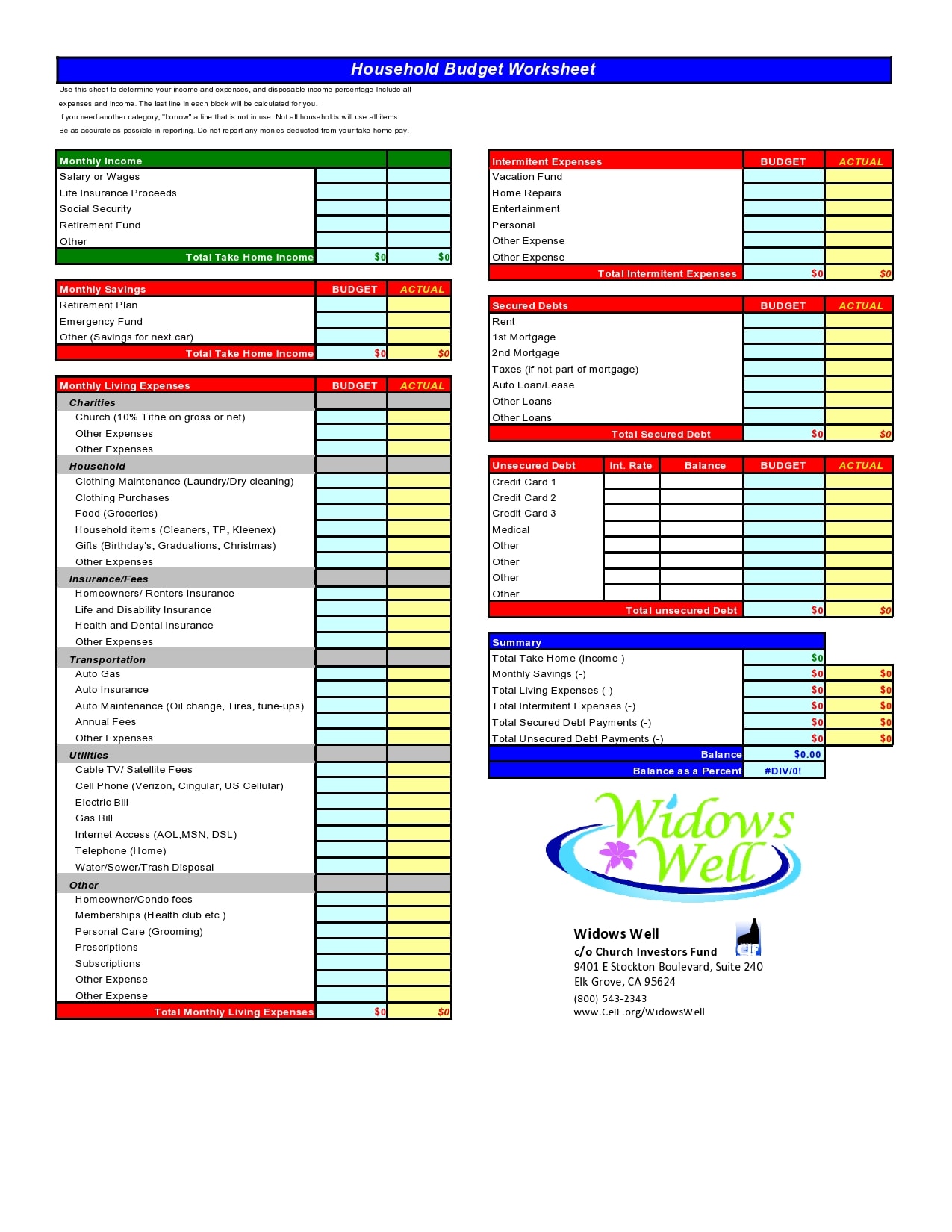

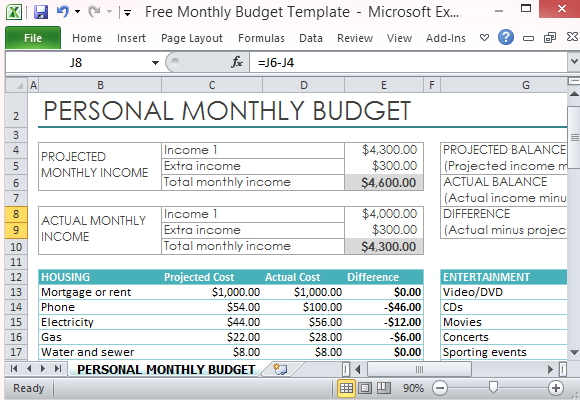

Your fixed expenses will include your recurring monthly bills, including mortgage or rent, phone and utilities, insurance, car payment, savings/retirement, childcare, tuition, and gym memberships for example. With a little research through your statements, you may be surprised to see just how much you’re spending. Don’t record what you think you should be spending on items such as groceries, but what you actually are.

When calculating expenses, put them into categories. When determining income, use the amount you bring home after taxes and after any other deductions, such as child support, are taken out. Build a budget, learn your spending habits, and keep a grocery list to keep you on track and responsible so you can reach bigger goals, like a new vehicle or a down payment on a house.A realistic budget starts with determining your monthly income and then calculating all of your monthly expenses. Choosing cheaper staple items like milk and yogurt can also make a huge difference over time.Īn accurate food budget that works for you helps you feel more confident and in control of your finances. Some stores might even offer bulk items - great for your favorite products and those with a long shelf-life. Check out the different shops in your area to find the best combination of quality and price. Your local farmers market, chain grocery, and organic store will all offer different specialties and sales. You can easily save 10 cents to a dollar per item, which adds up quickly over many trips.

Many packaged products have a huge price disparity between brand name and generic items, and store brand items tend to be cheaper without sacrificing much quality. Salads, sandwiches, and leftovers are all easy, inexpensive, and nutritious.

Push your monthly food budget further with delicious lunches from home. You can also make larger meals and plan leftovers for lunch so you have less to plan and purchase.Ī $13 lunch out might not seem like much, but it can blow your food budget fast if it becomes a habit. Try to plan for recipes that use the same ingredients so there’s less to purchase. This way you’re more likely to buy the exact items you need and can plan for breakfast, lunch, and dinner. Plan your meals ahead of time to determine the food items and quantities you need before you head to the grocery store. Frozen vegetables are great in soups and stews, and you can use frozen fruits for healthy breakfast smoothies. You can plan ahead and freeze prepared produce to save time on weekday cooking, or chop and freeze last week’s produce before shopping for more. Freeze Your Foodįreezing your fresh food before it goes bad helps your wallet and the environment. This can quickly get out of hand and push you over budget. It’s also important you make sure you actually need the item you’re purchasing instead of buying it for the sale. While a single coupon might not give you a large discount, you can save a lot with multiple coupons. These usually work in person or online, so you can shop when and how you like.

#Your monthly budget should include download#

Be sure to download and register your email for new updates and sales. Many popular grocery stores are rolling out apps that track your coupons and savings. Cut CouponsĬoupons are easy to find in the mail, in store, in your inbox, and even in a Google search. Trimming your food budget can help you stow away more for your financial goals, such as building an emergency fund or saving for a dream vacation. There are several ways to cut back on what you spend without sacrificing the quality and taste of your food. With a little practice, she’ll better learn her habits and be able to accurately adjust her budget. So she’ll need a total of $385 for food each month. She would budget six percent for groceries ($210) and five percent for restaurants ($175). For example, Rita makes $3,500 per month after taxes. With this framework in mind, you can calculate your total food budget based on your take-home income. Approximately six percent is spent on groceries, while five percent is spent dining out - including dates, lunches with coworkers, and Sunday brunch. It doesn’t all go towards groceries, though. Department of Agriculture, Americans spend 11 percent of their take-home income on food. Dining Outĭon’t forget what you spend at restaurants when you consider your food budget.

Go to Mint coach Purchasing Groceries vs.

0 kommentar(er)

0 kommentar(er)